International Expansion is not for the light-hearted

And why when Biz Ops drives, you stand a chance of winning

This post about the mess international expansion can be just landed and brought some memories. Today we will talk about how Biz Ops, with its analytical and operational capabilities, and sitting at the heart of an organisation, is the team that stands a chance to sort out the “mess.”

A few years ago I held the doubtfully envious position to head International Expansion at a well funded scale up. This scale up was called Hopin.

I say “doubtfully envious” because every time I told friends what my scope of work was, I got the Wows, and Ohhs, and all other deep-air-exhaling sighs. That is until I also told them, “it involves operating a massive spread sheet of 10 tabs, and 140 lines each to simply ‘keep track of what’s going on’; involves a team of 30-50 people across 5 acquired companies, and 10 departments, who all think expansion is something different; and my naturally assembled team of 5 who could barely cope.” Fun? Definitely. But difficult? You bet. International Expansion is not about flipping a switch.

I was in charge of making sense of the “mess” Elena speaks about. It was my job to make sense of the chaos and structure it in a way to helps us make decisions. That’s it. Simple. What is not simple is that very soon after I was put in charge of Expansion, I had to shock my leadership team. Because I could tell this was going to be TOUGH, and people needed to know. So I shocked them. I said we don’t have product-market-fit for (many) new markets. Now they listened, and now I could go away and do some work.

International Expansion takes itself seriously. You should do the same.

If you have a tendency to want to “simplify” everything you see, I hope you gain an appreciation of how much work in the complexity of expansion you need to do before your plan looks like “We are launching to France, and Italy next year. And here are the three bullet points why".”

You can’t expand with confidence until you do the complex work.

I followed this process for arriving at better decisions about expansion. It boils down into two frameworks - one for the Market Context, and one for the Company Readiness. The output is overall Market Desirability. I separated three Tiers, and each Tier had a priority in there too. Tier I, fairly easy:

MARKET CONTEXT: First the big elephant in the room - putting international markets on a map. Create a table with the top 20 markets in assess their TAM, WTP, maturity of your industry, and channels. You should use the 80/20 rule here. Don’t over-engineer, but allow for enough detail to help you compare, say, Portugal to South Korea, not just Portugal to Germany.

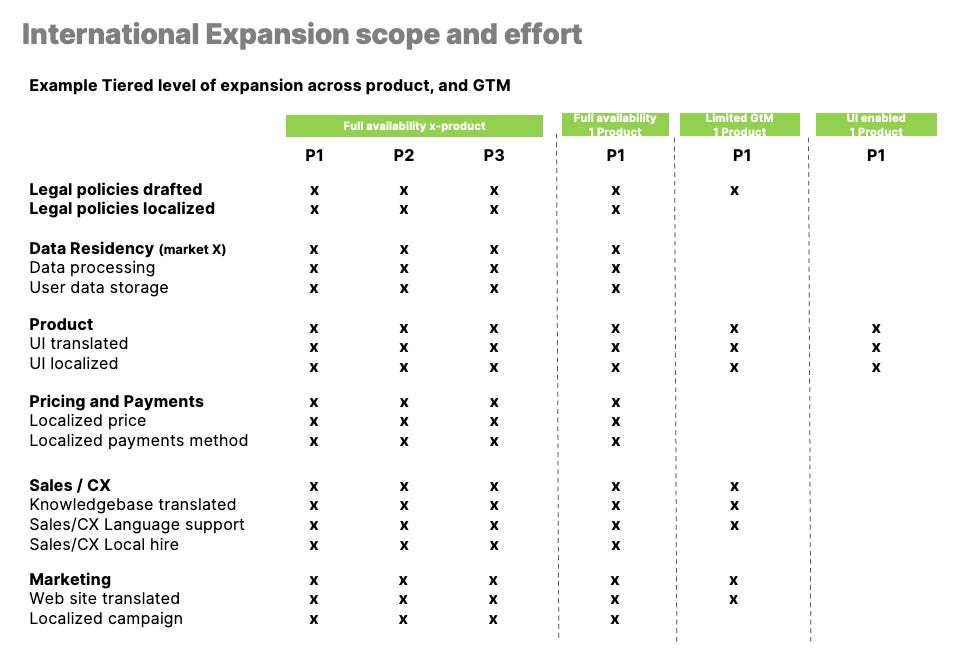

COMPANY READINESS: Second, across the top tier markets, you need to look at what would it take to enter those markets. What does a new market mean for your company across Product(s), GTM (all of GTM! From marketing, branding, to sales, to CSM, and to tech support), G&A, other risks/unknowns.

Hint: this is where you end up with numerous sheets, 120+ lines deep. The more products, use cases, packaging, localisation needed the more then the trickle down effects on GTM. Then you need think about the segmentation of the ICP, the messaging and branding, the way to buy, pricing and localisation of said pricing, channels, sales and CSM support, and tech support. If this proliferation of considerations is not enough, then you get into G&A, where you have a close encounter with finance and accounting operations, FX risk, payment currencies and methods, the legal requirements for those, data privacy (a whole balloon of its own), other risks, and top it all of - your finance and hiring models. Again, 80/20 for Tier 1. Chances are you know these answers and you don’t have much work do to close the gap.

MARKET DESIRABILITY: this looked like a fancy heat map, taking both previous frameworks and mashing them together. Across markets you could see what is green and what is red, across Product / GTM / G&A; and whether the skew was GTM red but Product green, or all green and G&A very red (I won’t name those markets..). But after all of this you could clearly see - Yes, we are going to X, and here is why.

Do the work to get to simplicity.

With Biz Ops, this is the first analytical bit. Then you get into operationalisation and working through your heat map to develop your Launch plan. Because ultimately once you sort out the fundamentals, your team cares about what a “Launch” of a market means. Here is a simplified example:

I will say this again, doing this for the top Tier is easy. Because you can barely go wrong if you follow this simple framework. You can do this whole process following 80/20 and draft something with a moderate level of confidence.

Where it gets interesting is prioritising the markets of your Tier II and Tier III. This is where I recommend conducting, or better commissioning, some research. You’d look at a more granular view of the economic context, and policy; tech infrastructure; culture around the product / service you are offering, including special operational considerations (e.g. Uber had to enable cash payments in India. That wasn’t easy…); industry dynamics including local competitors, ways of buying, and information flows.

Final word.

Expansion is tough. It is tough because it touches every.single.part. of the company. It is earned, not demanded. As a founder, you can’t just “want” to expand. You can’t flip a switch. You have to do the work.

Biz Ops sits across all the parties involved, and has the birds eye view across Product, GTM, and G&A. Use your Biz Ops accordingly.

To continue the conversation, connect with me here: https://www.linkedin.com/in/vessclewley/